Margin of Safety

Latest Posts

-

The U.S. 10-year Treasury is now at 1.42%, its lowest level since July 2012. What gives? Yes, Brexit has roiled the markets, but can money really be that cheap? It is. Relatively, 10 years are rich in yield.

This post isn’t about the flight to safety, however. It’s about how our governments have failed us. Central banks are out of ammunition, fiscal policies during the recession were just not aggressive enough. We can’t rely on central banks. It’s our fiscal and regulatory apparatuses that are broken.

I don’t have an answer. Neither does Janet Yellen. Governments have to change. Maybe that’s what Brexit is all about.

-

As I wrote on CFO.com on Tuesday, China’s domestic banks may face problems during the “great moderation” of China’s economic growth. A recent S&P report said that the majority of China’s top banks, and many regional and national banks, “remain vulnerable to credit shocks stemming from a hard-landing scenario for the Chinese economy.” They are not as healthy as they seem, according to this Economist piece: “The credit binge of recent years has left them with far higher levels of risky loans than they acknowledge.”

Will Chinese and Indian depositors get spooked? A lot of that credit binge was commercial loans — in particular, as I wrote yesterday, “Chinese banks also have heavy balance-sheet exposure to local government financing platforms (LGPFs) — risky state-owned enterprises established to finance infrastructure construction and urban development. They were in part set up to circumvent rules that prohibit local governments from borrowing. As much as 20 percent of the Chinese banking system’s total credit exposure (RMB 15 trillion, or $2.5 trillion) is in this sector, according to S&P.” The problem with that is the slowing Chinese economy may hit some of those borrowers hard, particularly the exporters.

India’s situation, at least currently, seems worse. Slowing economic growth is being compounded by a rapid depreciation of the rupee, which the FT says today threatens “to worsen asset quality and reduce demand for bank credit from large industrial companies.” The balance sheets of India’s banks are already bad — with nonperforming and restructured loans at about 9%, says the FT, quoting Morgan Stanley. That number could rise to 15.5 percent over the next two years.

There are a lot of moving parts here. Monetary policy in both countries will be key. It will be up to the Reserve Bank of India and China’s central government to figure out how to avoid toppling the banks. After all, in both nations the government play a huge role in the banking sector, a role that distorts free-market forces and has incentivized banks to make unwise underwriting decisions. It surely seems like the next banking crisis will come from both or one of these countries — and they may be contained or have global ramifications. Although 2008 seems not far away, we are about due for a crisis anyway.

Related articles

- UPDATE 4-BofA exits stake in China’s CCB with $1.5 bln sale (uk.reuters.com)

- Chinese Banks Struggle With NPLs Despite Resilient Earnings (valuewalk.com)

- China on verge of worst economic crisis in decades (globalpublicsquare.blogs.cnn.com)

- Read full text Part 1: Raghuram Rajan’s first speech as RBI governor (dnaindia.com)

-

What a week for Anchor Bancorp of Wisconsin. Its holding company declares bankruptcy, then the SEC comes out today with fraud charges against the CFO. (The case was settled.) A bad earnings report just added icing to the cake.

Anchor owed the Treasury $139 million in TARP debt. Like Anchor’s other creditors, Treasury settled for 3.3% of equity in the reorganized company. That equity is essentially worthless at this point. Not sure why the Federal Reserve and other regulators want to keep this bank alive. There’s also the question of the timing of these announcements. The company is saying they are coincidental. The SEC refused comment when I asked them. Waiting to hear from the Treasury Department, they’ll probably keep quiet too.

Another TARP banking company runs aground. Related articles

- Anchor BanCorp Announces Recapitalization (virtual-strategy.com)

- Anchor BanCorp: Associated Bank forced bankruptcy (nbc15.com)

- Anchor BanCorp Wisconsin Inc. Announces First Quarter Results (virtual-strategy.com)

- Anchor BanCorp defaults on U.S. Bank loan after Fed denies extension (bizjournals.com)

-

Is there any end to banks’ easing of standards on business loans?

Loan underwriting is getting pretty loose. The Federal Reserve’s Senior Loan Officer Survey for July shows banks easing standards (yet again) for industrial & commercial loans. The percentage of domestic U.S. banks easing actually was near the highest its been since 2011. Demand for C&I loans is high, and “spreads above funding” continue to narrow.

“About 20% of banks reported easing C&I lending standards to large/middle market firms over the past three months, including narrowed spreads and premiums charged, as well as extended loan durations, higher maximum credit lines and lighter covenant provisions,” said a note from Todd Hagerman and Robert Greene of Sterne Agee. What’s driving the trend? Seventy percent of the banks said competition from banks and nonbanks; 50 percent said an improving economy.

The Fed’s survey also showed increasing demand for commercial real estate loans, including construction and land development loans. I hope banks don’t get too aggressive on those balance-sheet busters again.

Greasing the skids for bankers everywhere. Image courtesy of wwarby’s photostream at Flickr and used under license of Creative Commons.

Related articles

- Fed Loan Survey Shows Easier Lending for Mortgages, Businesses (bloomberg.com)

- Demand for Business Loans Increasing, Credit Eases (blogs.wsj.com)

- Banks slightly ease mortgage lending standards (hsh.com)

-

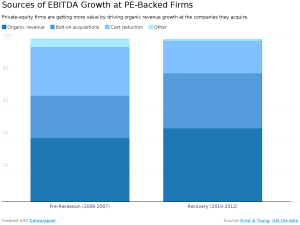

… but an E&Y study I wrote about yesterday claims they are creating value — with returns higher than the public markets — with some new “levers.” I’m not so sure. The businesses they have acquired are earning higher valuations on exit because the stock of their public-company peers is doing well. “Multiples, which compressed significantly during the post-crisis years and negatively impacted performance, have rebounded in the recovery period and accounted for 30 percent of overall PE returns,” the E&Y report says. And what about the value to the U.S. economy of all these high returns? PE firms are doing hordes of dividend recaps again, so the money is going to high net-worth and institutional investors. Is it driving jobs? Who knows.

Related articles

- Memo to the Eliot Spitzer: Private Equity Firms are Scamming New York City (nakedcapitalism.com)

- What’s Private Equity Good For? (blogs.wsj.com)

- Private Equity Exits Hit by Economic Uncertainty (pehub.com)